Enterprise Zones

In 1982, the original Illinois Enterprise Zone Act was created, leading to the Enterprise Zone Program. This program was updated in 2013. Its main goal is to boost economic development and improve neighborhoods in economically struggling areas of the state. It achieves this through a combination of state and local tax benefits, reduced regulations, and better government services.

What is an Enterprise Zone?

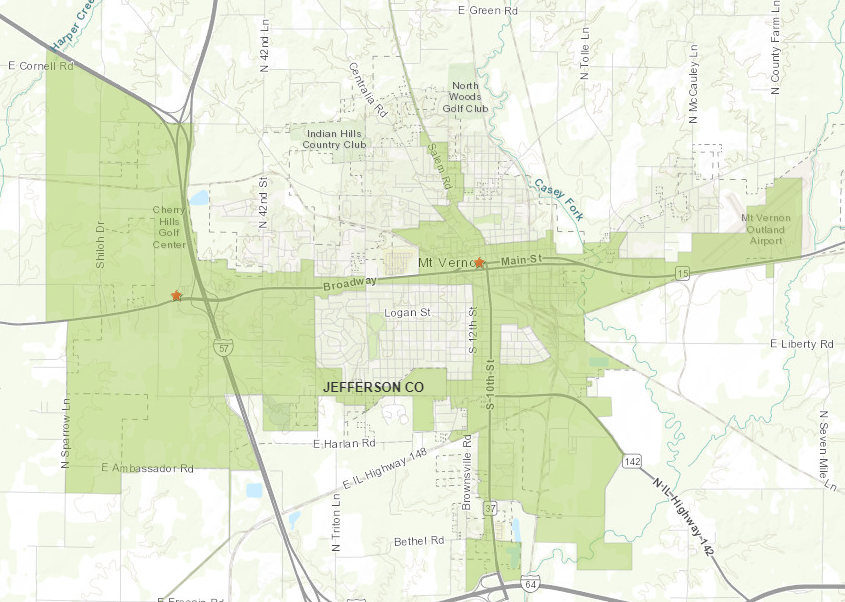

An Enterprise Zone is a specific geographic area that is designated by the state government to promote economic development and job creation. These zones are often located in areas with economic challenges, such as high unemployment or low income. Mt. Vernon has created an eleven square mile Enterprise Zone in which qualifying projects may receive incentives.

What kind of benefits can businesses get in an Enterprise Zone?

Companies that set up or expand in an Illinois enterprise zone can enjoy various state and local tax perks, including:

- Not having to pay the retailers' occupation tax on construction materials.

- Expanded exemptions from the state sales tax for items used in manufacturing or pollution control.

- An exemption from the state utility tax for electricity and natural gas.

- No need to pay the Illinois Commerce Commission's administrative charge and telecommunication excise tax.

- Enterprise Zone Construction Jobs Credits, which allow eligible project owners to reduce their taxable income by using received tax credits.

How to Apply for Enterprise Zone Benefits

To apply for approval of benefits, an Enterprise Zone application may be submitted along with your Building Permit application. (Please use this application if you are a contractor and want to apply for sales tax exemption.) Questions about Enterprise Zone benefits can be answered by the Building Inspection Department at 618-242-6830 or the Zone Administrator at 618-242-6802.